- Cryptocurrency market analysis april 2025

- Best cryptocurrency to buy april 2025

- Cryptocurrency market outlook april 2025

Cryptocurrency market news april 2025

Before mid-June, there won’t be much market action, with a high probability of range-bound fluctuations to form a bottom. April’s market may first decline, then fluctuate and rebound https://sha-zam.org/. For the next two months or more, don’t have expectations of getting rich quickly; take profits when possible, securing gains is the best strategy!

We strive for accuracy in our content, but occasional errors may occur. Importantly, our information should not be seen as licensed financial advice or a substitute for consultation with certified professionals. CoinRank does not endorse specific financial products or strategies.

This time, the non-farm data release is still far from the next Fed interest rate meeting (May 6-7), so as long as the data doesn’t show significant anomalies, the impact on crypto market trends will be limited.

CoinRank Exclusive brings together primary sources from various fields to provide readers with the most timely and in-depth analysis and coverage. Whether it’s blockchain, cryptocurrency, finance, or technology industries, readers can access the most exclusive and comprehensive knowledge.

Cryptocurrency market analysis april 2025

The final week of April brought a wave of optimism to the BNB market. One of the major highlights was the filing of a spot BNB Exchange-Traded Fund (ETF) application by a major asset management firm in the United States. This announcement triggered a notable rally, with BNB jumping by over 8% in a single session. The prospect of institutional access to BNB through a regulated ETF product signaled growing legitimacy for the token and significantly lifted market sentiment.

This sharp decline was largely influenced by macroeconomic uncertainties, including heightened geopolitical tensions and weak economic indicators from major global economies. Additionally, short-term profit booking by traders and concerns over regulatory pressure on centralized exchanges fueled panic selling. Liquidations across leveraged positions in the derivatives market further intensified the decline.

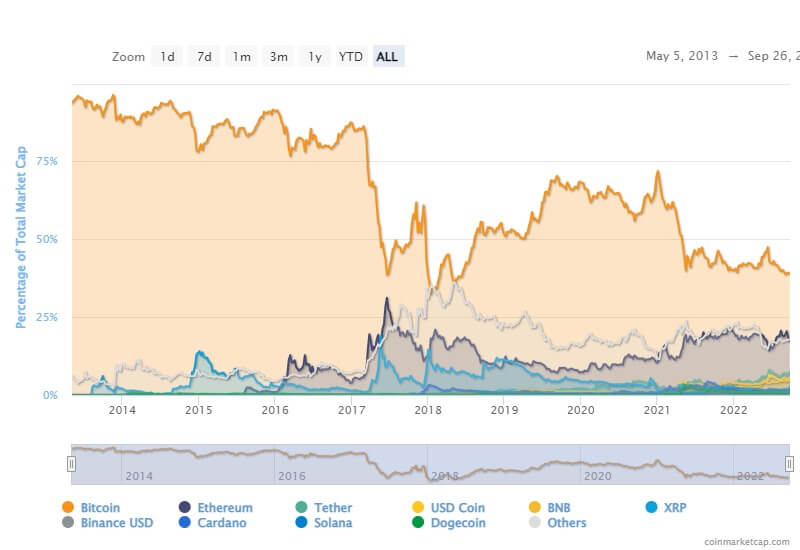

On April 29, 2025, the cryptocurrency market experienced noteworthy fluctuations. Bitcoin maintained stability around $95,000, despite the overall market capitalization seeing a significant drop from late 2024 highs, decreasing by $633.5 billion or 18.6% to $2.8 trillion. This decline in market cap was particularly stark compared to Ethereum, which saw a dramatic 45.3% drop in price.

Compared to the bustling March, April seems much quieter. The Federal Reserve has no meetings, and central banks of major economies are also temporarily subdued. We’ll see more continuation of relevant policies, such as the implementation of Trump’s tariff policies and the Fed’s slowing of balance sheet reduction.

This strategic appointment was welcomed by the market, with many observers anticipating greater compliance readiness and deeper integration into mainstream financial systems. However, this development did not immediately translate into a strong rally, likely due to broader market caution.

Best cryptocurrency to buy april 2025

The disjointed nature of blockchain ecosystems has long presented a significant roadblock to mainstream adoption. Each crypto network typically requires dedicated applications for basic use — a cumbersome user experience that limits broader participation.

Both a cryptocurrency and a blockchain platform, Ethereum is a favorite of program developers because of its potential applications, like so-called smart contracts that automatically execute when conditions are met and non-fungible tokens (NFTs).

“Like it or not, if the Trump administration can light a fire on the cryptocurrency side of things, ethereum could potentially be a big beneficiary, and the value could increase significantly,” said John Foard, CFP and co-founder of Crown Advisors. “It’s slightly a speculative play, but worth a small allocation to see what happens.”

Qubetics brings a fresh twist to online privacy with its decentralized VPN. With over 508 million $TICS already sold in its 30th presale stage and a price of $0.1729, it’s being eyed for massive gains. Its practical real-world applications in privacy-heavy regions give it a unique edge.

The disjointed nature of blockchain ecosystems has long presented a significant roadblock to mainstream adoption. Each crypto network typically requires dedicated applications for basic use — a cumbersome user experience that limits broader participation.

Both a cryptocurrency and a blockchain platform, Ethereum is a favorite of program developers because of its potential applications, like so-called smart contracts that automatically execute when conditions are met and non-fungible tokens (NFTs).

Cryptocurrency market outlook april 2025

The March Fed FOMC statement indicated that the Federal Reserve will begin slowing the pace of balance sheet reduction on April 1. The Fed will reduce the cap on Treasury securities redemptions from $25 billion/month to $5 billion/month, while maintaining the cap on MBS redemptions at $35 billion/month.

The ETH/BTC ratio will trade below 0.03 and also above 0.045 in 2025. The ETH/BTC ratio, one of the most-watched pairs in all of crypto, has been on a perilous downward trend since Ethereum switched to proof-of-stake in September 2022’s “Merge” upgrade. However, anticipated regulatory shifts will uniquely support Ethereum and its app layer, particularly DeFi, re-igniting investor interest in the world’s second-most valuable blockchain network. -Alex Thorn (Note, a prior version of this report said ETHBTC would finish above 0.06, which was a typo).

Additionally, it’s important to monitor the actual technical implementation effects, focusing on actual user experience improvements after the upgrade (such as reduced Gas fees, increased transaction speeds), Layer 2 scaling effects, etc. If internal personnel turmoil and governance disagreements within the Ethereum Foundation continue, it may also affect the efficiency of future upgrades.

In April 2025, the cryptocurrency market is witnessing a range of trends that are reshaping investor strategies. Decentralized Finance (DeFi) continues to grow, with more investors participating in lending, trading, and yield farming activities. The rise of stablecoins, digital assets pegged to traditional currencies, is providing lower volatility investment options. Meanwhile, Non-Fungible Tokens (NFTs) maintain their popularity, driven by art, music, and gaming sectors’ adoption. Blockchain’s integration with Artificial Intelligence (AI) also is providing new use cases and efficiencies, offering promising technological advancements. These shifts highlight the market’s adaptability and the growing acceptance of blockchain technology beyond traditional finance.

Short-term catalyst effect: Historically, major Ethereum upgrades often serve as catalysts for price increases. For example: after the Chaella upgrade in April 2023, ETH rose 45%; before the Dencun upgrade in March 2024, ETH gained 70%. If the Pectra mainnet upgrade goes smoothly, the market may speculate on the technical benefits in advance, driving ETH to continue rising and touching the $2,800-3,000 range.